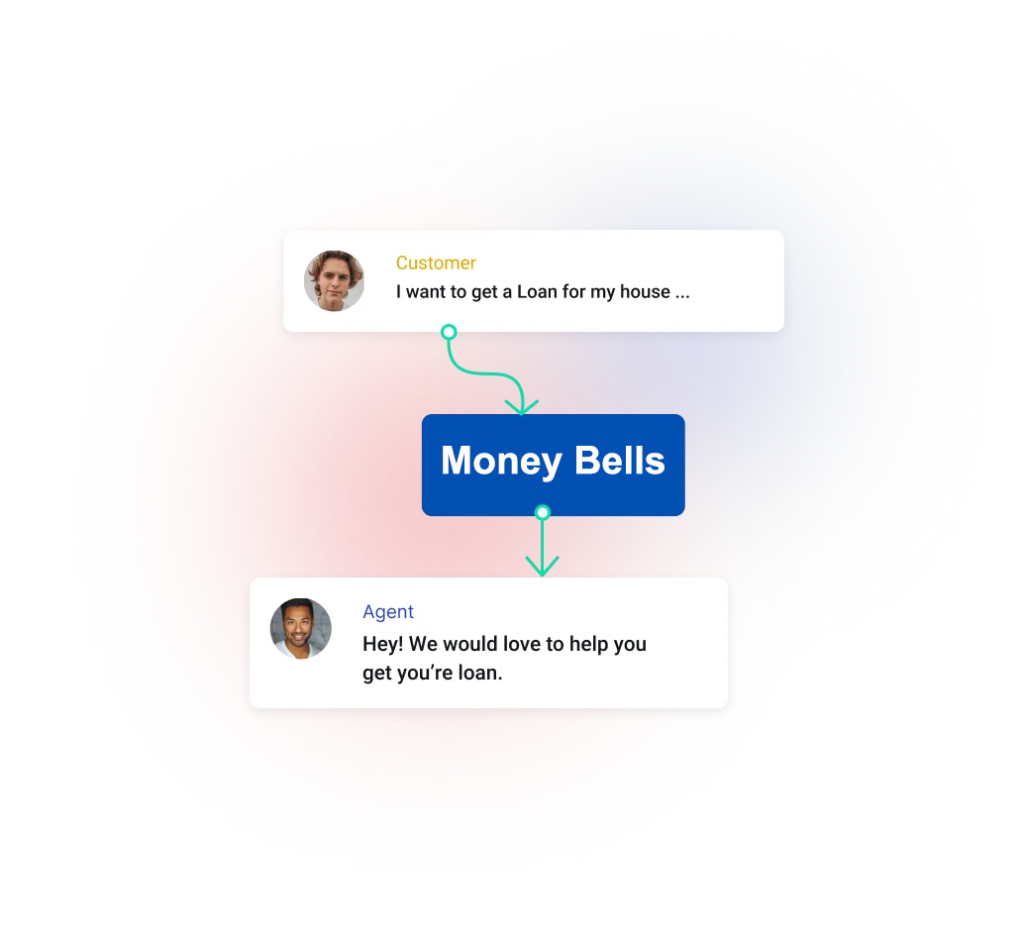

At Money Bells, we understand that every financial situation is unique. That’s why we offer personalized consultations to help you navigate your loan options and choose the best solution for your needs.

High Range Loan

25 years + experience as an industry expert

Fast, Easy & Transparent

Applying for a loan is hassle-free with Money Bells' user-friendly platform and streamlined processes designed to save your time and effort.

We ensures your financial data and transactions are protected with state-of-the-art security measures, offering peace of mind with every loan process.

We believe in clear communication—no hidden fees or surprises, just honest and open information throughout the entire loan process.

We are committed to providing accurate information and genuine advice to empower you to make informed financial decisions.

Depend on Money Bells for consistent support, timely disbursements, and a team dedicated to your financial success.

Thousands of happy clients trust Money Bells for their financial needs, showcasing our dedication to exceptional service and results.

Our foundation is built on trust and accountability, ensuring every interaction reflects our commitment to high moral standards.

From flexible repayment options to expert guidance, Money Bells offers numerous benefits to make your loan journey smooth and rewarding.

Unlock the value of your property with a loan against it. Money Bells offers competitive interest rates and flexible repayment terms, helping you access the funds you need without selling your asset.

Maintain smooth business operations with a working capital loan from Money Bells. We offer quick access to funds, ensuring your business has the liquidity it needs for day-to-day expenses and growth.

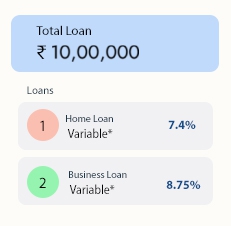

Make your dream home a reality with Money Bells’ easy and affordable home loans. We offer personalized loan options with attractive rates, ensuring you get the best deal for your new home.

Expand or establish your business with a commercial property loan from Money Bells. We offer flexible solutions for purchasing commercial real estate, helping you secure the perfect location for your business.

Transform your space with a renovation loan from Money Bells. Whether it's a simple makeover or a major overhaul, we provide the funds to bring your vision to life, with easy terms and quick disbursal.

Fuel your business growth with a tailored business loan from Money Bells. Whether you're starting a new venture or expanding an existing one, we provide the financial support to help you achieve your goals.

That is why we have a wide range of loans, you can apply for a Personal Loan, Home Loan.

Money bells guide on the supervisory approach to consolidation in the banking.

At Money Bells, we understand that every financial situation is unique. That’s why we offer personalized consultations to help you navigate your loan options and choose the best solution for your needs. Our experts are here to provide guidance, answer your questions, and ensure you make informed decisions at every step of the process.

Money Bells stands out with its commitment to transparency, secrecy, security, and customer satisfaction. We offer personalized consultations with a simple yet efficient process and quick disbursement of funds. Our reputation precedes us because of our commitment to honesty, integrity, and reliability.

More than that we are just not another name in the block we are a LPO i.e. Low Profit Organization upto 30% of our profit goes towards the betterment of the society, servicing for the social cause and upliftment of the under privileged community.

This is the charge that’s levied by the financer for early full or part-payments

The documents typically required include proof of identity, proof of address, income details like: salary slip & from 16 for salaried individuals or ITR, computation & balance sheet for self-employed. Property documents (for specific loan types). The exact requirements may vary depending on the loan type.

We master the act of fast and efficient process. Provided we receive your application and all required documents, we aim to provide approval within 7-10 business days. Disbursement of funds follows promptly after approval and submission of singed loan agreement.

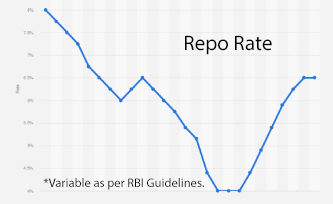

The Repo Rate is the interest rate at which the Reserve Bank of India (RBI) loans money to commercial banks.

The current Repo Rate in India, fixed by RBI is 6.50%. As per the latest news, the repo rate remained unchanged for the eleventh consecutive time since February 2023, as announced on 6th December 2024.